The propylene glycol market in 2019 is evidently weak and low, and the overall trend is downward. Mainly affected by the negative factors of raw materials and supply and demand, the price of propylene glycol has repeatedly hit historical lows in recent year.

The propylene glycol market is generally weak in 2019. Firstly, the cost of PG has dropped more than in 2018, which creates the space for PG to go downwards. Secondly, the production equipment loads are all maintained at a high level, and the output has increased more than before. The PG has been in oversupply for a long time. In addition, demand-side support is weak. Downstream plants’ demand is not high. During the year, the wait-and-see attitude of the lower reaches of the market was high, and most of them chose to replenish inventory when prices were low. Furthermore, as international competition intensifies, export orders are often heavy at low prices, but demand is reduced when prices rise, resulting in small price increases and short rise times.

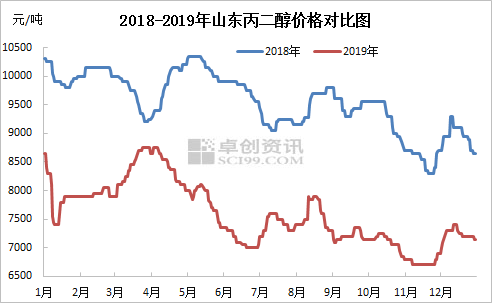

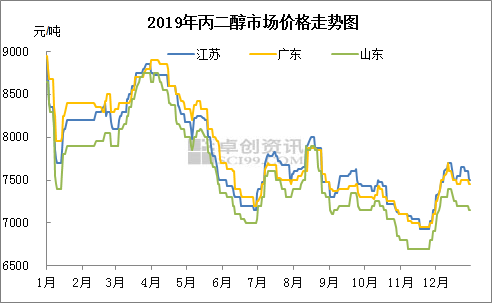

Looking at the price trend from 2018 to 2019, the downward trend of PG is obvious. The prices in 2019 dropped significantly compared to the prices in 2018, but the relative prices trend basically matched. The big differences are as follows: early in April 2019, demand recovered and export orders increased to the highest level in the year, while in the same period last year, the price of PG was lowest in the first half of the year due to the slow demand recovery and costs fall; the market situation in the third quarter of 2019 was more diverse.

The trend of PG in 2019 can be divided into four stages:

In the first quarter, it rebounded after bottoming out. Due to limited demand support, and control of inventory before the Spring Festival, PG continued its downward trend since last year, dropping EXW at a price of 7,400 RMB / ton. Inventory was transferred at a low price. Demand was slowly recovered after the Spring Festival. Some units were shut down for maintenance. In addition, suppliers actively maintained export orders. The price rebounded and reached the highest price of 8750 RMB / ton this year at the end of March. The average price in the first quarter was 8085 RMB / ton, a drop of 9.14% from the fourth quarter of last year and a decrease of 18.4% from the first quarter of last year.

In the second quarter, PG was in a weak downward phase. Production facilities are staggered, but downstream demand support is not high. The East China Polyether Plant has limited production and the resin production load is low. International market competition has intensified and exports have been blocked at high prices, then costs have been more negative after mid-month, so the PG market has weakened downward. In May, the cost was stimulated by short-term positive news, coupled with the shutdown of more propylene glycol units, which resulted in supply shrinkage. At the same time, downstream stocking started, so the market price increased slightly. However, with the restoration of supply, prices are still low. The average price in the second quarter was 7802 RMB / ton, which was a decrease of 3.49% quarter-on-quarter and a year-on-year decrease of 21.54%.

In the third quarter, PG was staggered in low level. The basic trend of each month in July, August, and September is the inverted V operation that moves up and down. At low prices, the downstream enter the market to replenish stocks, and export orders also increased. Subsequently, the supply side’s inventory fell, and the market went up. After some loose orders chase high prices, the downstream market is in conflict with high prices, so transactions are not smooth. After the increase in sales pressure, the supplier negotiated low-price delivery and shifted down their focus. Among them, due to the short-term centralized shutdown of the Shandong plants in August, the supply in the market shrank more, resulting in the largest increase in the month in the third quarter. The average price in the third quarter was 7,401 RMB/ton, down 5.15% month-on-month in the second quarter and 21.29% year-on-year in the third quarter of last year.

In the fourth quarter, PG suppressed first and then increased, and then weakened at the end of the year. After the National Day holiday, downstream demand has weakened, while the on-site supply has been relatively stable. The delivery of export orders has fallen then suppliers’ pressure has increased. so they continue to negotiate and shift their focus to a low level for the year; At low prices, the downstream actively explored export markets, coupled with replenishment of downstream inventory. As the factory’s inventory shifted, market began to rise upward, and some demand parties entered the market to chase up, pushing the price slowly upward; At the end of the year, demand weakened and inventory was still low. Supplier’s pressure was not great, but the focus of trading was still slowly moving downward. The average price in the fourth quarter was 7025 RMB / ton, a decrease of 5.08% from the third quarter, and a decrease of 21.05% from the fourth quarter of last year.