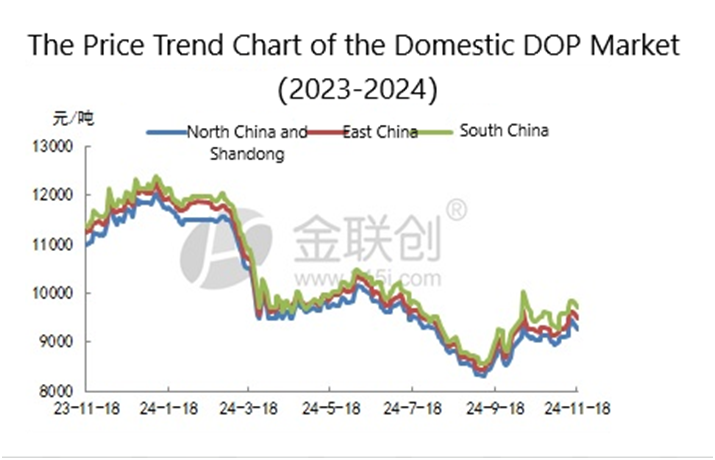

Introduction: Since entering November, driven by the increase of raw material octanol, the DOP market has been comprehensively pushed up. Taking the East China market as an example, the price of DOP has risen from 9,100 yuan per ton to 9,700 yuan per ton, with a price difference of 600 yuan per ton and a price increase of 6.59%. However, the disadvantages brought about by the too rapid upward trend are also difficult to avoid. At present, the market has entered a downward mode. Regarding the recent downward trend of the DOP market, the following analysis will be carried out.

The maintenance facilities for the raw material octanol have been restarted, reducing the speculative factors in the market. Moreover, the supply of octanol will increase. When the expectations are not good, the price of octanol has taken the lead in dropping. Taking the East China market as an example, the price of octanol has already fallen from 9,900 yuan per ton to 9,600 yuan per ton, with a decline rate of 3.03%.

The demand side has not improved sufficiently, with only small demand purchases for DOP. Previously, the DOP market was pushed up to a high level. Due to the intensified resistance from the downstream, there have been very few new orders. At present, although the price of the DOP market is continuously dropping with concessions, the situation of insufficient downstream buying interest persists, and there is still an expectation of a downward trend in the future market. Currently, the lowest price of DOP in East China is 9,450 yuan per ton, a decrease of 250 yuan and a decline rate of 2.58%.

The outlook for the future market is not optimistic, and it is expected that the DOP market still has room for further decline. The operating rate of the DOP industry is at a relatively high to medium level. Although there is over-selling, DOP merchants still mainly focus on shipments and face the problem of poor new order transactions. It is expected that the price of raw material octanol will still tend to be weak in the short term, and phthalic anhydride is also not good. The cost transfer to DOP is ordinary. Recently, DOP merchants face a situation where both costs and demands are weak. To reduce the resistance to shipments, the phenomenon of price concessions is likely to continue. However, considering the poor profit situation and the still relatively tight supply of some goods, it is expected that the extent of the decline may be restrained, and the overall trend will be mainly a weak and slow downward movement.

(Source: JLC)