【Introduction】According to the normal logic analysis, March is the time for the recovery of chemical demand. For propylene glycol, in addition to the domestic demand, the industry also has good expectations for the export market in March. However, after the actual entry into March, the performance of propylene glycol was not as good as expected, in the following aspects.

Insufficient follow-up of export orders

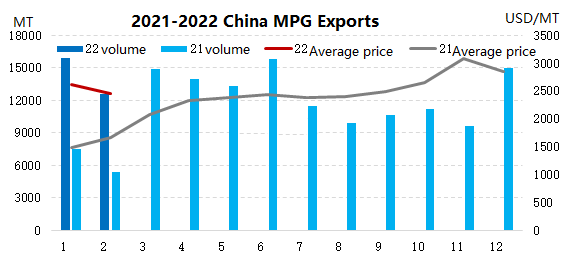

From January to February, although the domestic demand for propylene glycol declined due to the Spring Festival, the overall market was driven by the support of export orders, and domestic inventories were not under pressure. As can be seen from Figure 1, the export volume of propylene glycol in January-February 2022 will increase significantly compared with the same period last year.

Under conventional inertial thinking, the industry also has expectations for exports in March. However, after entering March, changes in the international situation made exporters more cautious; at the same time, rising international energy prices increased production costs, which inhibited downstream construction to a certain extent, so global demand declined, which in turn reduced China’s exports.

Slow recovery of domestic demand and weaker local demand

In February, domestic downstream demand was in a slow recovery stage, and March will be the time for full release of terminal demand, and downstream demand will further pick up. However, around mid-March, the transportation of goods around the country was sluggish, especially in Zibo, Changzhou and other major downstream concentrated areas, which inhibited demand, and the overall market sentiment remained weak.

Taking unsaturated resin as an example, the comprehensive operating rate of the industry in early March was around 26%, and by the third week of March, the operating rate was about 23%, which not only did not rise but fell by 3 percentage points.

Prices fail to follow the rise in raw materials, and plant profits decline

From the perspective of raw materials, the price of propylene oxide mostly followed the rise of raw material propylene in the middle and early ten days, but it failed to rise in the price trend of propylene glycol.

The propylene oxide transesterification plant has maintained a high profit since the second half of last year. In 2022, the price of dimethyl carbonate will first fall to a low level, and the profit of the plant is fully supported by propylene glycol. However, under the pressure of supply and demand, the price of propylene glycol is also mainly in a downward trend. In March, both foreign trade and domestic demand performed poorly. The rise in raw materials did not drive the price of propylene glycol to rise, so the profit of the device also fell from a high level. But overall, the profit of transesterification is still considerable. If it is pushed back from the profit level, some industry players believe that high profits give propylene glycol to continue to fall.

Changes in demand are the main factor behind price fluctuations

Judging from the current supply and demand fundamentals, the start-up of the device is basically normal, and the individual shutdown or load reduction has little impact on the overall output, the market supply is sufficient, and the pressure on factory shipments still exists. On the demand side, the transportation situation between some regions is gradually recovering, or the downstream demand may rebound to a certain extent. However, there is no good news for exports recently, and the domestic terminal demand is still weak. Therefore, the downstream operation mode of maintaining low inventory may be difficult to form a sustainable market. (source: SCI99)